Managing employee expenses can be a tedious and time-consuming process especially if you do not have the right policies, practices or tools in place. The costs that you can’t control are the ones that often come back to bite you. If employees are given full autonomy in managing their spendings, company expenses can get out of control.

To help companies keep on top of things, we have prepared a list of 5 steps companies can follow to take back control and better manage employee expenses.

1. Set clear and concise policies with reasonable limits

Having an unclear policy or more precisely, a lack of policy in place is one of the reasons why employees overspend. The first step to managing employee expenses is to write up a clear and concise expense policy and ensure proper communication of the policy to your employees.

If you are not sure how to set up policies for your company, check out our article on How to write an effective corporate travel and expense policy or get a free copy of our Travel and Expense Policy Template.

Expense policies should specify the type of expenses that employees are allowed to claim on, circumstances that may qualify or disqualify a claim, as well as spending limits for each expense category. When clear guidelines are provided, employees are more aware of the company’s expectations and understand that they will not be reimbursed if they spend extravagantly.

Although it is good to remind your employees that they are accountable for their spendings, do bear in mind that spending limits should be practical and flexible to some degree to ensure that it applies in most legitimate scenarios. Overly tight budgets can be stressful and frustrating for employees to keep to, and could unnecessarily distract them from more important matters.

2. Provide company payment methods

It is common practice for employees to pay out of their own pockets for travel, food and other expenses, then spend weeks waiting for that money to be reimbursed. This can be taxing for employees especially if these amounts add up to a significant percentage of their salary. Employees have their own financial commitments as well, and it isn’t fair for them to have to bear the burden of company expenditure.

To get around the issue, the company could release company payment methods to trusted employees so that expenses are directly borne by the company and at no time in the process imposes financial burdens on employees. This also ensures that companies acquire first-hand data on spending amounts and can be better assured of the existence of the expense.

A popular way of doing this is to issue company credit cards for personnel who tend to have larger spending needs. Companies that are more risk-averse could also consider applying for prepaid options such as the Mastercard Business Prepaid Card where employees could be issued spending cards with pre-determined balances to limit the risk of misappropriation.

Another ideal solution is for the company to work out credit or prepaid arrangements with preferred vendors so that expenses incurred by employees with these vendors are all directly paid by the company. On Navisteps, companies could easily set up and edit employees’ access to company payment methods such as the company credit account and prepaid account with Navisteps or any specified company credit cards. This would not only resolve the issue of financial burden on employees, but also ensure that the company receives faster and better documentation of transactions directly from the vendor. This greater visibility into employee spend puts the business in control over how much employees are spending.

3. Digitise receipts and invoice

While manual processes remain the default choice for expense management in small companies, it is inefficient and comes with hidden costs that could have a significant impact on the bottom line.

By digitising source documents such as receipts and invoices, the company effectively files and indexes the documents electronically in a database. As opposed to manual and physical filing systems, data and documents can be easily called out in seconds with a series of keystrokes - shorter than the time it takes for you to walk to the filing cabinet.

Digitisation also preserves the documents for longer, since an electronic receipt never yellows, crumbles or fades out. Having easy access to reliable source documents also means that employees are less likely to get away with abuse and hence effectively discourages employees from engaging in fraudulent activities.

On the other spectrum, humans aren’t perfect, and it isn’t unheard of for employees to lose receipts for legitimate expenses. When that happens, it can be a massive waste of time going back and forth between different parties to get claims appealed, investigated and approved.

With digital tools such as Navisteps, employees can easily upload images of receipts on the go, which greatly lowers the risk of physical receipts getting lost or damaged. Claims get filed and paid faster, and the company also benefits from handy data to better analyse and manage expenditures.

4. Implement and review policy

The effectiveness of a good policy hinges on its implementation. Simply having a brilliant set of policies alone is in itself inadequate without firm execution and regular review.

After drawing up the company’s policy, it is important that the company follows through by communicating policy details to employees and setting up mechanisms to ensure employees observe guidelines.

Expense management software such as Navisteps would be especially helpful in this regard, providing automated safeguards against employee contraventions without the need for additional effort. With consistent application of policy guidelines, employees are bound to be more mindful to keep expenses within policy definitions.

Data should also be periodically reviewed to ensure compliance as well as the continuing relevance of policies. Effective policies cannot remain effective forever. As business needs change, spending requirements could transform drastically as well. Existing measures and yardsticks may become obsolete; new measures may be needed to address new challenges. Where changes to existing policies are required, communication and implementation is again key to keep employees informed of updates. Companies utilising Navisteps for expense management can simply edit and customise policies as and when required for immediate execution without fuss. At the same time, employees always know where to access and view the latest applicable policies, and can easily get up to speed with the latest policies.

5. Automate expense management

Happy employees are more productive and tend to stay loyal to the company. When implementing an expense management process, make it as simple and convenient as possible for employees to follow. If employees have to follow a complicated process every time they need to claim for expenses, it becomes a niggling irritation that slowly eats away at employee satisfaction and loyalty. Employees may then become less inclined to make spending decisions that best benefit the company.

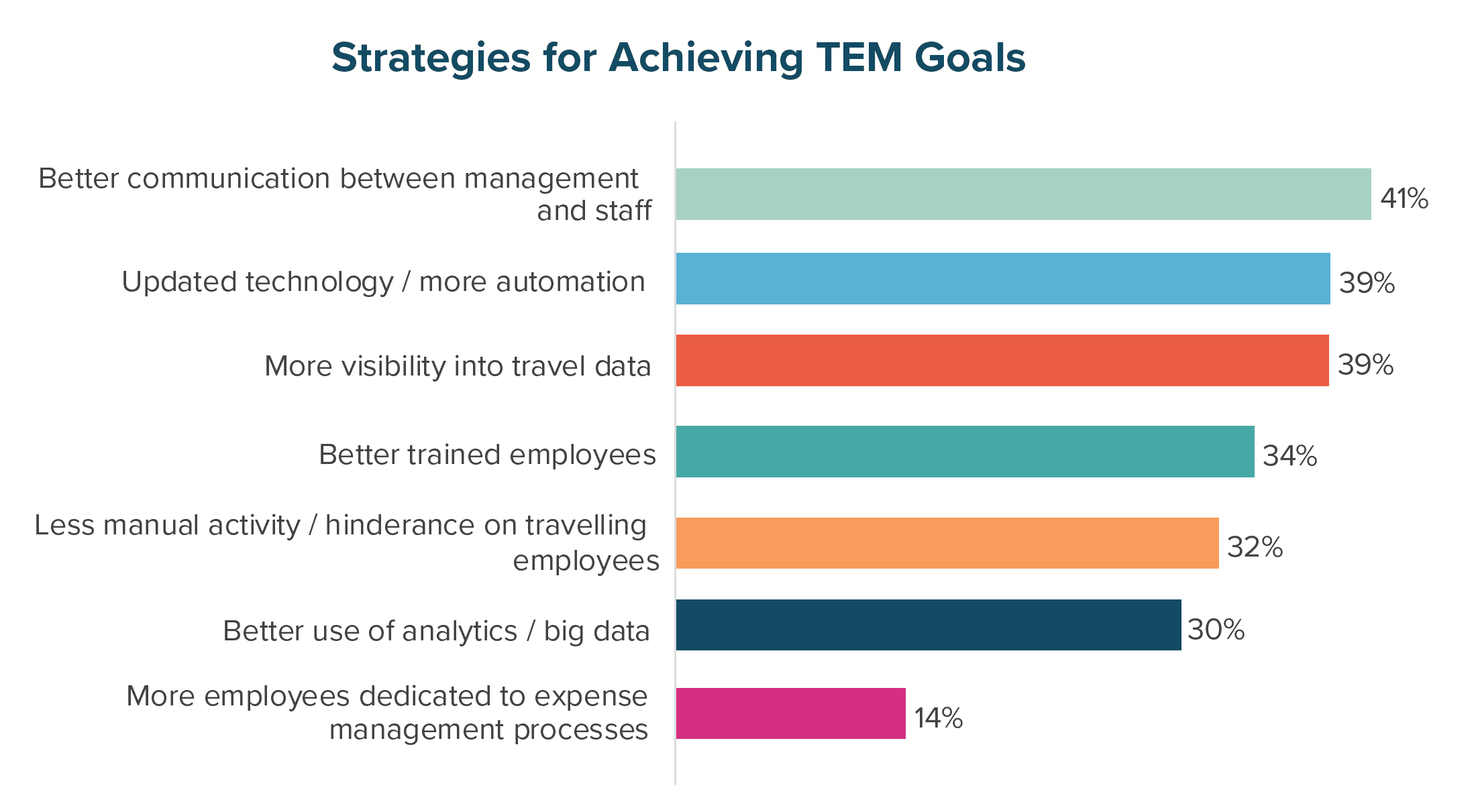

The easiest way to make the process as painless as possible would be to invest in an expense management system. According to a report written by Paramount Workplace, the second most popular strategy for controlling expenses is to have updated technology or more automation.

Organizations’ top strategies for managing expenses (Source: Paramount Workplace)

Organizations’ top strategies for managing expenses (Source: Paramount Workplace)

When everything from capturing expenses to approvals and reporting become automated. managers no longer have to lift a finger as the process can take care of itself.

In addition, automation of policy enforcement and possession of reliable data records also act as powerful defences against employee fraud, which is a very real problem for companies worldwide. According to the Association of Certified Fraud Examiners’ 2018 Report, expense reimbursement fraud accounts for 21% of fraud in small businesses (<100 employees), and 11% in large businesses (>100 employees).

It is always good to have fraud control measures in place such as proper validation and verification of expenses to guard against abuse. With the use of automation tools in expense management systems such as Navisteps, the company is endowed with wider visibility into company spend. This improves its ability to monitor and manage its expenses, which in turn also deters fraud.